private placement life insurance singapore

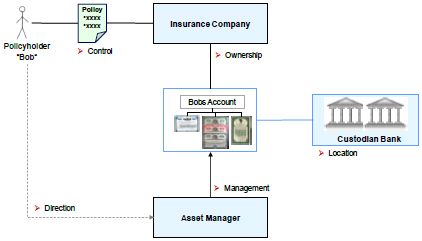

In other words PPLI presents a planning structure just like trusts. Introducing Private Placement Life Insurance PPLI 萬方家族辦公室 private placement life insurance singapore private placement life insurance singapore.

Introducing Private Placement Life Insurance Ppli Raffles Family Office

This can be seen for the Keppel REITs private placement of new shares where they raised a total of S270 million in a private placement with a fixed issue price of S1130.

. Private placement life insurance has been around for decades but its growing appeal is due in part to the changing industry dynamics. Ultimately these deferred gains can be received income-tax free at the passing of the insured in the form of a death benefit. On NMGs numbers Asia HNW1 life insurance volumes were USD12bn in 2020 up 4 on 2019 though still materially down on high watermark levels before heightened restrictions on the capital outflow from China and the Hong Kong protest movement.

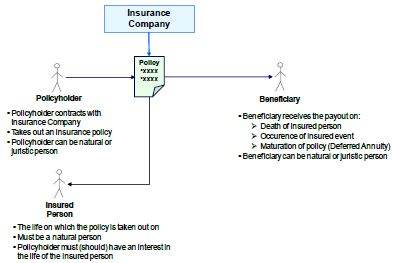

Private placement life insurance or PPLI is a customized version of variable rate insurance not available to the general public. Private placement life insurance is a type of variable universal life VUL insurance1that allows investments contained within the policy to grow with income and capital gains taxes deferred. EBITDA allowance 1717 Vs 168.

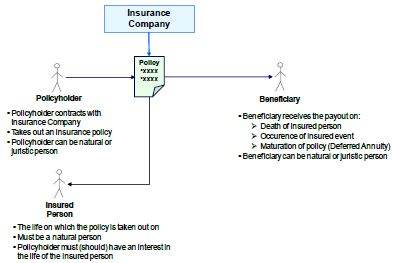

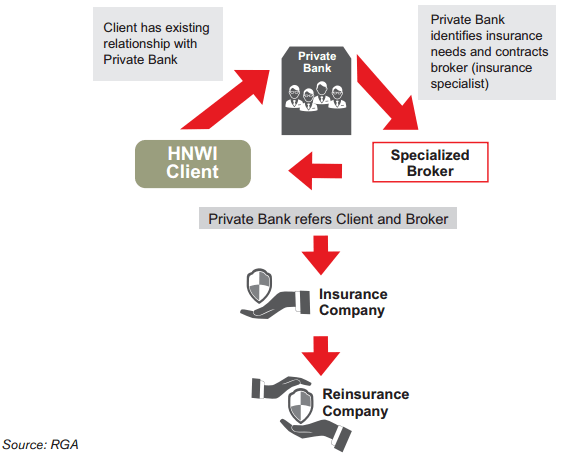

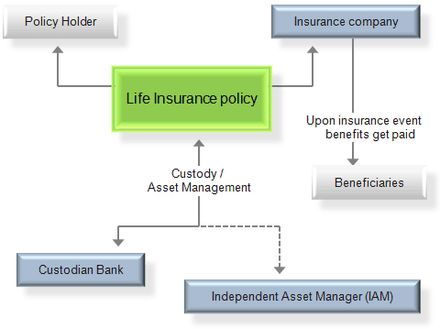

It is based on life insurance and annuity policies that allow for bespoke tailored and internationally diversified investment strategies. We customise solutions using private placement life insurance PPLI to meet the complex needs of clients. Get an Instant Free Quote Online.

We currently administer over 200 Private Placement Life Insurance and Annuity Investment Accounts. Private Placement Life Insurance is at the core of our superior customised and portable wealth solutions that address the needs of high net worth individuals their families and institutions to help them ensure their assets are protected portable and can be passed on. This is at.

PPLI policies are designed to maximize the amount of deposits that can grow tax-free or tax-deferred in the case of a private placement annuity. Private placement life insurance is a variable universal life insurance policy that provides cash value appreciation based on. No Visits to the Doctor.

Net accumulation up 14 at Rs 20099 crore Vs Rs 17639 crore. Ad Save Precious Time Money While Getting the Best Possible Coverage. For example the price of new share issuance cannot price at more than 10 discount to the weighted average price of trades done for the full day of placement.

PPLI policies are generally designed to optimize the use of a life insurance policy as a tax-shielded investment account within the statutory safe harbor of Section 7702. Ad Over 12 Million Families Trust SelectQuote. Shop The Best Rates From National Providers.

Recommended final allotment of Rs 11 per allotment of face amount of Rs 10. We are licensed in over 30 countries we work with over 48 insurance companies in over 15 different jurisdictions and offer tax compliant solutions for clients from over 50 countries. Are you a Legal or Tax practitioner with an interest in Private Placement Life Insurance and have some questions on how to arrange the structure.

Read the article here. Private Placement Life Insurance May 2022. The Singapore Branch will focus on customised concepts for private placement life insurance PPLI.

PPLI combines high-end life insurance with wealth management services including retirement and estate planning. Private Placement Life Insurance is at the core of our superior customised and portable wealth solutions that address the needs of high net worth individuals their families and institutions to help them ensure their assets are protected portable and can be passed on. Life Auto Home Health Business Renter Disability Commercial Auto Long Term Care Annuity.

Hong Kongs Richest. Winged Keel Group is widely recognized as one of the leading experts in the structuring and administration of Private Placement Life Insurance and Annuity Investment Accounts. A single premium life policy it provides wealthy clients with high value life cover whose death benefit proceeds can cover any inheritance tax due on the investors estate.

Private placement life insurance PPLI is a niche solution designed for wealthy individuals who want to invest in hedge funds but avoid the associated high tax rates. Under Singapores sections 13D 13O and 13U exemptions on specified income derived from designated investments. In addition an attorney will be needed to help draw up the documents adding to the cost of the purchase.

Get Your Free Life Insurance Quote Today. This article by Brendan Harper is a guide to how the PPLI process works and identifies the role of the Legal practitioner and how they can add value throughout the process. We estimate that Asia accounts for approximately 15 of total HNW life.

Ultra-affluent families utilize Private Placement Life Insurance and. A clear example is the fact that high-caliber money managers. Tailored to each client therefore it is known as private placement.

This is a versatile type of insurance policy used by high net worth HNW individuals to achieve PATEC. PPLIs are structured as variable universal life insurance policies. Within our 1291 family you are connected to an international group of top professional experts in the field of Private Wealth Solutions.

Private placement life insurance PPLI provides another solution. Due to its nature private placement life insurance is only offered to qualified purchasers seeking to invest large sums of money often more than US1 million in the policy. The product is often also known as private banking insurance or insurance wrappers.

Swiss Life Private Placement plans to contribute significantly to Swiss Lifes future growth by 2012 with a GWP of CHF 5 to 8 billion SGD 6 to 9. SelectQuote Rated 1 Term Life Sales Agency.

Hnw Life Insurance Riding A Wave Of Demand With A Diversified Product Range Asian Wealth Management And Asian Private Banking

/life_insurance-5bfc31f246e0fb0026029f39.jpg)

Differences Between Iul And Whole Life Insurance

Hnw Uhnw Life Insurance In Asia Opportunities Challenges For The World Ahead Asian Wealth Management And Asian Private Banking

Hnw Uhnw Life Insurance In Asia Opportunities Challenges For The World Ahead Asian Wealth Management And Asian Private Banking

Set Up And Cost Of Private Placement Life Insurance And Deferred Variable Annuities Who Is Involved And How Does It Work Financial Services Switzerland

What Is Private Placement Life Insurance Lombard International

Top 10 Pros And Cons Of Variable Universal Life Insurance

What Is Private Placement Life Insurance Lombard International

Swiss Life Companies Enter Into Deferred Prosecution Arrangement For Abusive Private Placement Life Insurance Policies

Private Placement Life Insurance

Selling Life Insurance Successfully To The Hnwi Market

Private Placement Life Insurance Wikiwand

Introducing Private Placement Life Insurance Ppli Raffles Family Office

What Is Private Placement Life Insurance Lombard International

Hnw Life Insurance Riding A Wave Of Demand With A Diversified Product Range Asian Wealth Management And Asian Private Banking

Set Up And Cost Of Private Placement Life Insurance And Deferred Variable Annuities Who Is Involved And How Does It Work Financial Services Switzerland

Assignment Of Life Insurance Policy Types Details Rules

Hnw Uhnw Life Insurance In Asia Opportunities Challenges For The World Ahead Asian Wealth Management And Asian Private Banking